It has come to my attention that not everyone is as enthralled by income taxes as I am. There were those couple…or few…client meetings when one, or maybe both, clients nodded off and fell out of their chairs, completely disappearing from view in our virtual meeting. But we financial planners get excited about this stuff, particularly when a big budget bill like the “One Big Beautiful Budget Act” or “OBBBA” passes. A fair amount of complexity has been added to the tax code for individuals, families, and small businesses. Might anything in there be useful to you? Let’s sort it out.

I’m not going to try to summarize the potential impact of OBBBA on individual taxpayers in a single blog post—you wouldn’t want to read it (unless you’re another financial planner or a tax person) and I wouldn’t want to write it. Instead, I’m going to provide a pretty high-level review focusing on areas where you may want to take action now and particularly changes that will go in to effect for the current tax year.

Tax enthusiast in training, circa 1966…

Current income tax brackets are now “permanent”

OBBBA effectively ended eight years of uncertainty over the scheduled sundown in 2025 of most of the changes made in 2017 by the Tax Cuts and Jobs Act (“TCJA”). Many of the TCJA provisions—lower tax brackets, higher standard deduction and Child Tax Credit, were made “permanent”. “Permanent” means that there is no scheduled end date for these provisions—they will remain in effect until a future Congress passes a bill that changes them.

For years I have pointed out to clients that our income tax brackets: 10%, 12%, 22%, 24%, 32% 35% and 37%, are historically low income tax rates. If you have gotten into the habit of doing Roth conversions in anticipation of being in a higher income tax bracket later, you’ll want to recheck your strategy to see if it still works now that these lower tax brackets are permanent.

Standard Deduction increases in 2025

These new “permanent” amounts will be adjusted for inflation annually.

Enhanced Deduction for Seniors

Also new in 2025 is an additional $6,000 deduction for each person aged 65 or older. This deduction, which can be taken along with either itemized deductions or the standard deduction, phases out as income increases. It will be available from 2025 through 2028. You’ll find more details about this enhanced deduction in my last blog post.

Limit on the deduction of State and Local Taxes Increases to $40,000

Very few Americans have benefited from itemizing deductions since the TCJA took effect in 2018. By simultaneously raising the standard deduction and limiting the deduction of state and local taxes (“SALT”) to $10,000, less than 10% of taxpayers had enough itemized deductions to exceed the standard deduction. In 2025, the SALT deduction limit increases from $10,000 to $40,000. The limit will then increase by 1% each year from 2026 to 2029 and will revert to $10,000 in 2030. All filing statuses will have this same limit except for married filing separately (“MFS”) for which it is 50% or $20,000 in 2025.

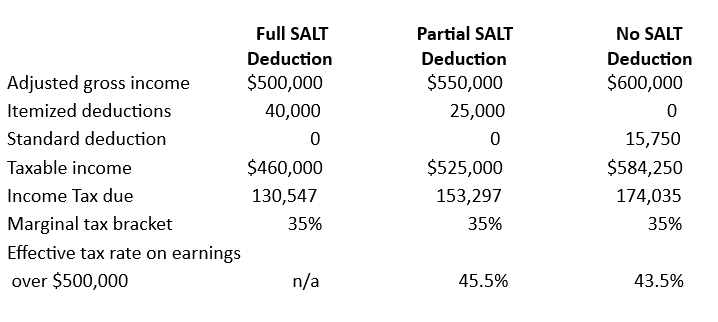

This higher SALT deduction is available for households with modified adjusted gross income (“MAGI”) of $500,000 or less. As MAGI exceeds $500,000, it is reduced by 30% of the amount over $500,000 until it reaches $10,000 at MAGI of $600,000. This is the case for all filing statuses except MFS where the threshold is $250,000 and the deduction drops to $5,000 by $300,000 of MAGI. From 2026 to 2029, both the amount of the SALT deduction limit and the phase down limits will increase by 1% annually.

The following example shows that for a single person in a high tax state who would be able to take advantage of the full $40,000 SALT deduction, there’s a high cost to earning more than $500,000. An additional $50,000 of income will only yield $27,250 after federal taxes; $100,000 results in only $56,512 after federal taxes. If you’re in this situation, you may want to reduce or defer income to keep the benefit of your SALT deduction.

Clean Energy Tax Credits End Soon

Several clean energy tax credits that were introduced in 2022 and originally scheduled to end in 2032 or later will now end this year:

· Clean Vehicle: A new or used electric vehicle must be purchased before September 30, 2025 for a credit of $7,500 or $4,000, respectively.

· Energy Efficient Home Improvement: A credit of up to $1,200 for improvements (heating and cooling equipment, windows, doors, insulation and home energy audits) in place before December 31, 2025.

· Residential Clean Energy—a credit of up to 30% of the cost of purchasing and installing wind power, fuel cell equipment, geothermal heat pumps or solar panels for expenditures made before December 31, 2025.

If any of these are on your radar, consider whether it makes sense to move forward in this newly compressed time frame in order to receive the credit.

Bonus Math Tidbit—the Value of Deductions vs. Credits

While both deductions and credits can save tax dollars, they work in different ways. For example, let’s look at a single taxpayer with taxable income of $75,000. This person is in the 22% income tax bracket—the last dollar she earned will be taxed at 22%. If she gets an additional $1,000 deduction, her taxable income drops to $74,000 and she saves $220 (22% of that $1,000). Nice! However, if she receives a $1,000 credit, her tax bill will be reduced by the entire $1,000. Even nicer! Credits are worth more than deductions! Here are the actual calculations:

Still with me? I know, probably more than you wanted to know about income taxes! But this is the fun stuff we get to figure out when the folks in Washington make changes to the tax code. Next blog I’ll describe some changes to how we can deduct charitable contributions and car loan interest, new deductions for tip and overtime income, changes to estate taxes, 529 accounts, the Child Tax credit and Qualified Business Income deductions, and the new Trump accounts. If you want help figuring out how this may impact you, contact your tax professional or send me a message!

Investment advisor representative of and investment advisory services offered through CGN Advisors, LLC, a fee-only SEC registered investment advisor. Tel: (910) FEE-ONLY. Fair Winds Financial Advice may offer investment advisory services in the State(s) of North Carolina, Texas and in other jurisdictions where exempted. Click here for additional disclosures.