This is blog post #3 of my brief summary of the recent budget bill. Previous posts were on taxation of Social Security and then the first part of my description of what’s in the bill. For an 870-page bill, this summary is neither short nor comprehensive. However, with this post I’ll complete my effort to describe the impacts that I believe will be most important to my clients. Today I’ll write about changes to the Child Tax Credit, the new deductions for taxpayers with tip income or overtime pay, car loan interest, and charitable contributions, the extension of the Qualified Business Income deduction (“QBI”), changes to the itemized deduction of charitable contributions, the estate tax exemption and 529 accounts, and the new “Trump” accounts. There’s a lot of ground to cover, even in just summary form, so let’s jump right in.

Mystery! Suspense! The Complete Sherlock Holmes—about the same length as OBBBA but so much more fun!

Child Tax Credit increases are now permanent[1]

The Child Tax Credit increased from $1,000 to $2,000 per qualifying child with the Tax Cuts and Jobs Act (“TCJA”) in 2018. This temporary increase was made permanent by the One Big Beautiful Budget Act (“OBBBA”) and even increased to $2,200 for the current year. Starting in 2026, it will be indexed to inflation.

While the entire credit may be used to offset taxes owed, only $1,700 is refundable if there isn’t a tax liability. This credit is available to households with modified adjusted gross income of up to $200,000 (single “S” and head-of-household “HOH”) or $400,000 (married filing jointly “MFJ”).

Some New Deductions

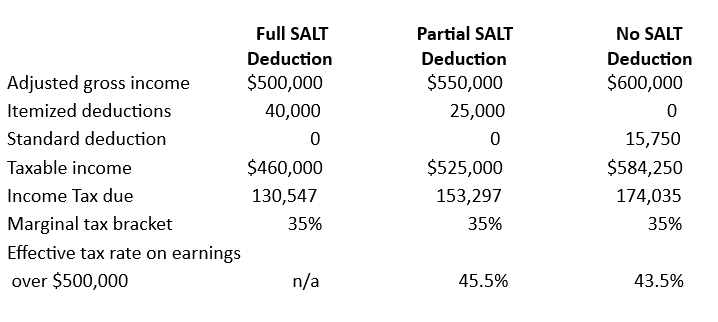

In the past, most deductions were taken as part of a group of itemized deductions. You either took the standard deduction or, if the sum of all of your itemized deductions was larger, you took the itemized deductions. In 2018, the TCJA created a new kind of deduction that could be taken independent of whether you itemized deductions or took the standard deduction. This was the QBI deduction (more on this one below). OBBBA has added a few more of these deductions. I described the additional deduction for seniors in a previous post. Today we’ll look at deductions for tip income, overtime pay, auto loan interest and charitable contributions.

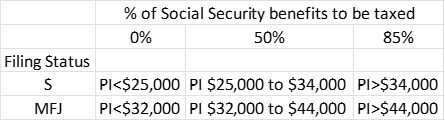

As we saw in my recent blog post on the taxability of Social Security, concepts that sound simple and straightforward as campaign sound bites tend not to be either simple or straightforward to apply. The next three deductions illustrate this nicely:

Deduction for tip income: Up to $25,000 in qualified tip income will be deductible annually between 2025 and 2028. The amount is the same regardless of filing status S or MFJ. To “qualify”, the work must have “traditionally and customarily” received tips prior to 2025, tips must be voluntary and can not be earned through a “Specified Service Trade or Business”[2] Clearly doctors, lawyers and financial planners can’t deduct tips (thanks for asking!), but neither can entertainers, musicians or artists. The deduction phases out at $100 for each $1,000 of income over $150,000 and $300,000 for S or HOH and MFJ, respectively.

Deduction for Overtime Pay: There’s also a new deduction for overtime compensation—up to $25,000 for MFJ and $12,500 for other filers, from 2025 through 2028. This deduction phases down to zero between $150,000 and $275,000 for S or HOH and between $300,000 and $550,000 for MFJ.

Only the income that is paid in addition to the normal wage is eligible for this deduction. For example, if regular pay is $15/hour and overtime is $22.50/hour, only the additional $7.50/hour qualifies for the deduction, not the base pay of $15/hour. Also note that employment taxes (FICA) will still be due on the overtime portion of the pay.

Deduction for Car Loan Interest: Interest of up to $10,000 per year on “qualified passenger vehicle loans” will be deductible from 2025 through 2028. New vehicles (cars, pickup trucks, vans, SUVs, and on-road motorcycles with GVW < 14,000 lb.) that are assembled in the US are eligible. Interest on loans taken out or refinanced (without increasing the balance) after December 31, 2024 will be deductible. The deduction phases down to zero between income of $100,000 and $149,000 for S and $200,000 and $249,000 for MFJ.

Deduction for charitable contributions: Generally, charitable contributions have only been deductible for taxpayers who itemize deductions. During the pandemic, a temporary deduction of charitable contributions of $300 for S and $600 for MFJ was added for those who take the standard deduction. However, it was only in effect in 2020 and 2021. OBBBA makes permanent a charitable deduction for non-itemizers starting in 2026--$1,000 for S and $2,000 for MFJ. Only cash contributions qualify and they may not be used to fund a donor-advised fund.

A few more things that have changed

As mentioned earlier, the QBI deduction for owners of pass-through business entities (sole proprietors, partnerships, S corporations) was created by the TCJA in 2018 and scheduled to end this year. OBBBA essentially made this deduction permanent with a couple of changes added:

1. The income levels at which the deduction phases out were raised a bit; and

2. A new minimum deduction of $400 for taxpayers with at least $1,000 of qualifying business income.

While those taxpayers who do not itemize deductions will have a pretty straightforward charitable contribution deduction starting next year, the opposite will be true for the itemized deduction of charitable contributions. This is a deduction category that was already complicated with different limitations on deductibility based on what is donated (cash or property of different types) and by the type of organization receiving the donation. Starting next year, there will be a 0.5% of adjusted gross income floor on the deductibility of charitable contributions. For example, a taxpayer with AGI of $100,000 would have to subtract $500 from the amount of charitable contributions and then apply the limitations based on property type and charity type to arrive at the deductible amount. The bottom line is that charitable contributions will result in smaller deductions in 2026 and beyond.

When 529 accounts were created in the 1990s, they were intended as a vehicle for saving to fund higher education. The TCJA added an allowance for K-12 tuition as a qualified expense for 529s. Now OBBBA expands qualified expenses to include K-12 expenses beyond tuition and certain post-secondary credentialing expenses.

One final change—if you were concerned about the federal estate tax exemption reverting from close to $15 million this year to $5 million next year, rest easy. The exemption will be $15 million in 2026 and will be indexed for inflation going forward.

And one final new addition—the creation of “Trump” accounts. Think of these as retirement savings accounts for children without the earned income requirements of individual retirement accounts (IRAs). US citizens born in 2025, 2026 and 2027 are eligible for a $1,000 US government credit to a Trump account. However, no contributions can be made before July 2026. There are lots of details of these accounts that will need to be clarified between now and then.

This has been a long and winding post, but that’s all I have to say in summarizing the OBBBA. Even with three blog posts, I’ve barely scratched the surface of what’s in this bill. And, of course, the actual application of most of these provisions entails plenty of small print. If you want help figuring out how these changes may affect you, contact your tax professional or send me a message!

[1] See previous blog post for an explanation of what “permanent” means in this context.

[2] This category was created to differentiate service providers like doctors and lawyers from manufacturers when the QBI deduction was introduced.

Investment advisor representative of and investment advisory services offered through CGN Advisors, LLC, a fee-only SEC registered investment advisor. Tel: (910) FEE-ONLY. Fair Winds Financial Advice may offer investment advisory services in the State(s) of North Carolina, Texas and in other jurisdictions where exempted. Click here for additional disclosures.